UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the registrant ý

Filed by a party other than the registrant ¨

Check the appropriate box:

|

| | | | | | |

| | | | | | | |

xo | | Preliminary proxy statement | | | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

oý | | Definitive proxy statement | | | |

| o | | Definitive additional materials | | | |

| o | | Soliciting material under Rule 14a-12 | | | |

QEP RESOURCES, INC.

(Name of Registrant as Specified In Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| |

| ¨ | Fee paid previously with preliminary materials. |

|

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| |

| (1) | Amount previously paid: |

QEP Resources, Inc.

1050 17th Street, Suite 800

Denver, Colorado 80265

April 5, 20184, 2019

To Our Shareholders:

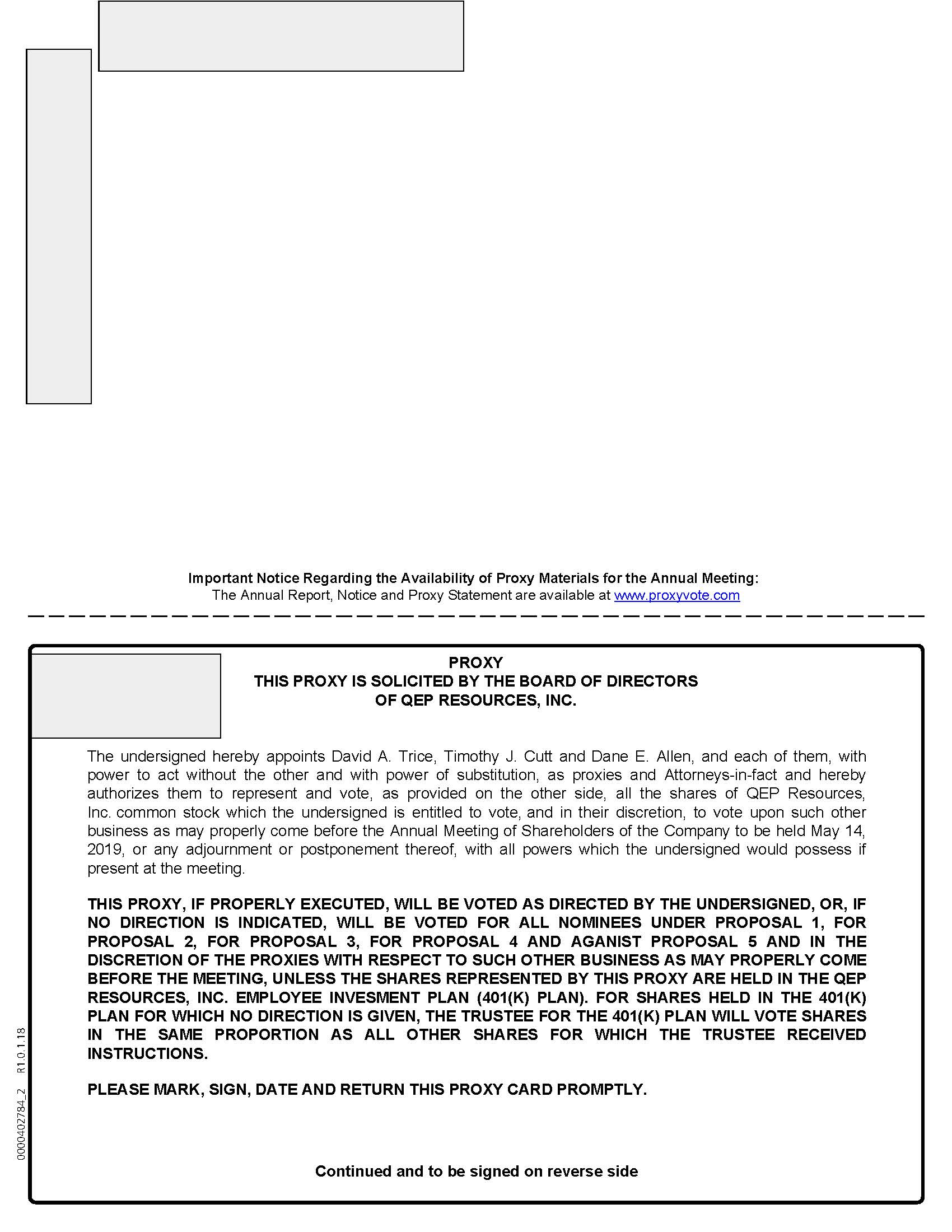

The 20182019 Annual Meeting of Shareholders of QEP Resources, Inc. (Annual Meeting) will be held on May 15, 2018,14, 2019, at 8:00 a.m. (Mountain Daylight Time), at the Company’s offices, 1050 17th Street, Second Floor, Denver, Colorado 80265.

The Corporate Secretary’s formal notice of the meeting and the proxy statement appear on the following pages and provide information concerning the matters to be considered at the Annual Meeting.

Your vote is important. You may attend and vote at the Annual Meeting. IWe urge you to vote whether or not you plan to attend the Annual Meeting. You may vote by Internet or by telephone using the instructions in the Notice of Internet Availability of Proxy Materials, or if you received a paper copy of the proxy card, by signing and returning it in the envelope provided.

All of the public documents, including our 20172018 Annual Report on Form 10-K, are available in the Investor Relations section of our website at www.qepres.com. The Annual Report does not form any part of the material for solicitation of proxies. I also encourage you to visit our website during the year for more information about QEP.

IWe hope you will attend the Annual Meeting; Iwe welcome the opportunity to meet with you. On behalf of the Board of Directors and management, Iwe would like to express our appreciation for your continued support.

Sincerely,

Charles B. Stanley

ChairmanChair of the Board President

and Chief Executive Officer

QEP Resources, Inc.

1050 17th Street, Suite 800

Denver, Colorado 80265

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 15, 201814, 2019

To the Shareholders of QEP Resources, Inc.:

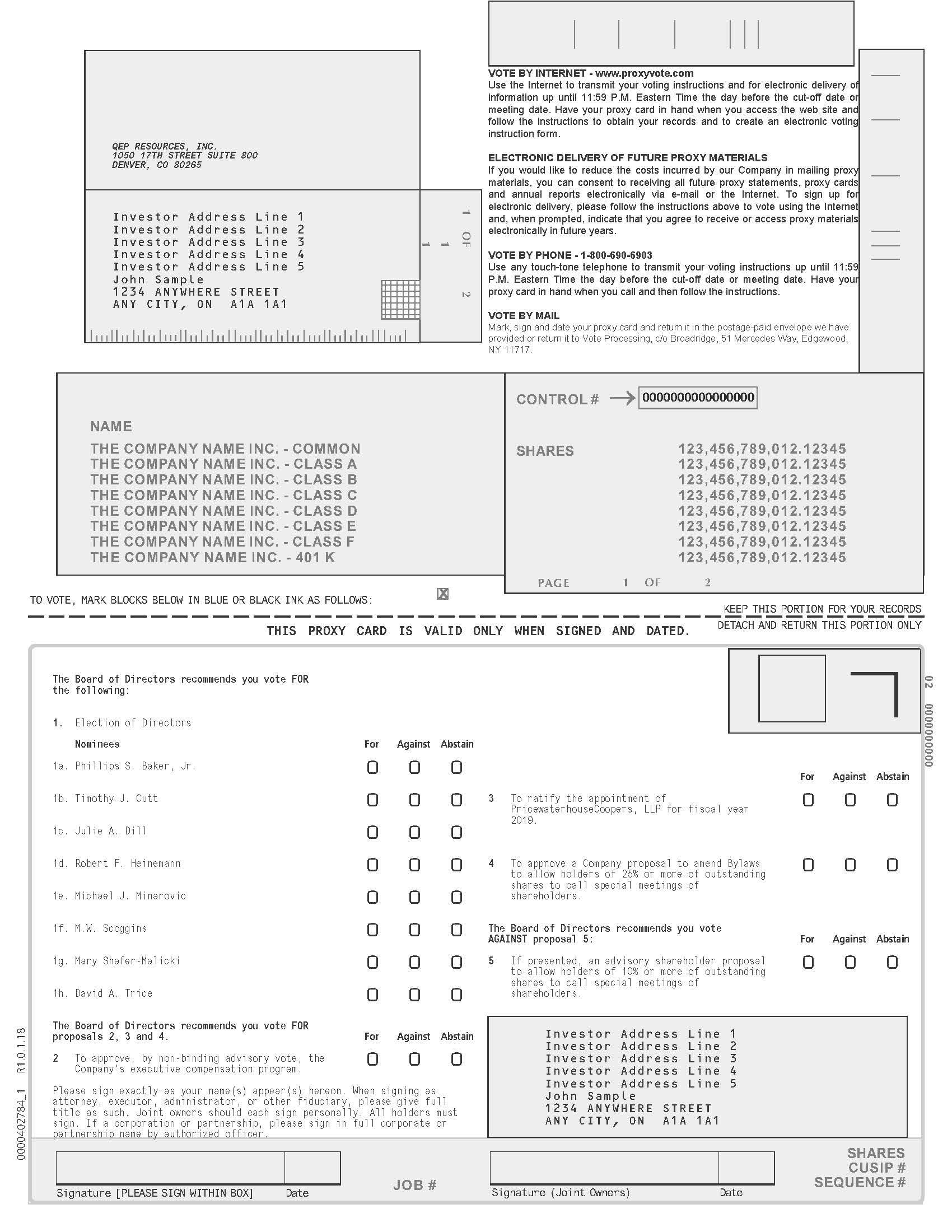

The Annual Meeting of Shareholders of QEP Resources, Inc., a Delaware corporation (the Company), will be held on May 15, 2018,14, 2019, at 8:00 a.m. (Mountain Daylight Time), at the Company’s offices at 1050 17th Street, Second Floor, Denver, Colorado 80265. The purpose of the meeting is to:

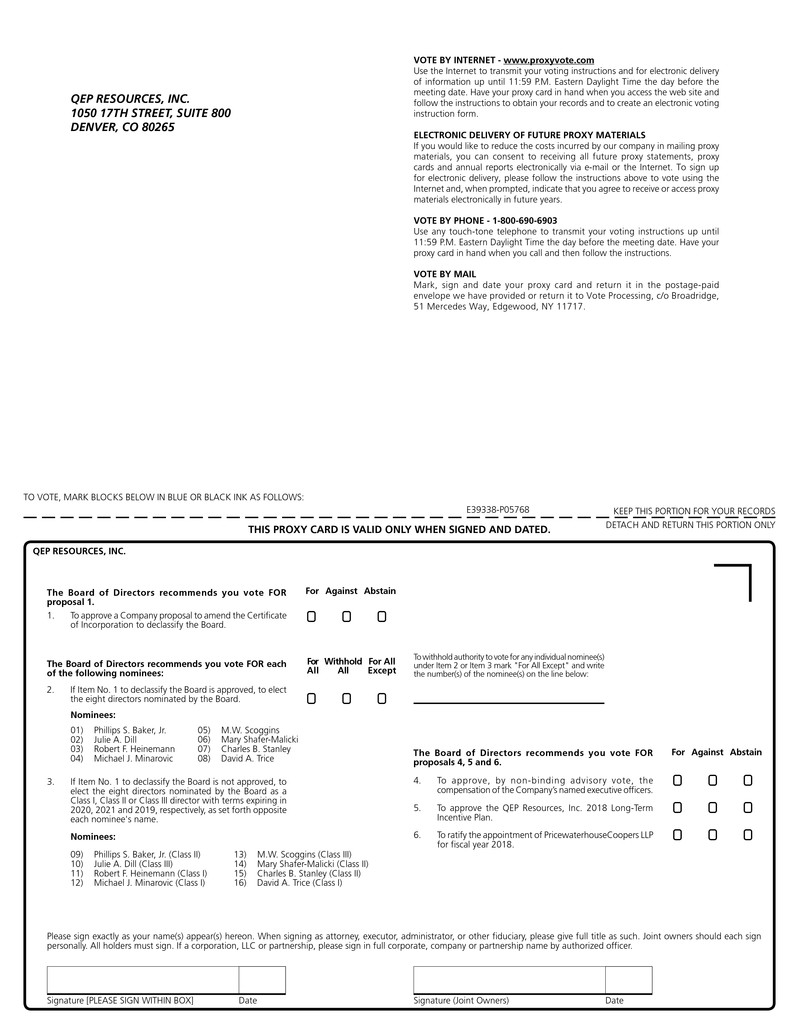

| |

| 1. | Approve a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors (Board) and to provide for the annual election of directors (Item No. 1); |

| |

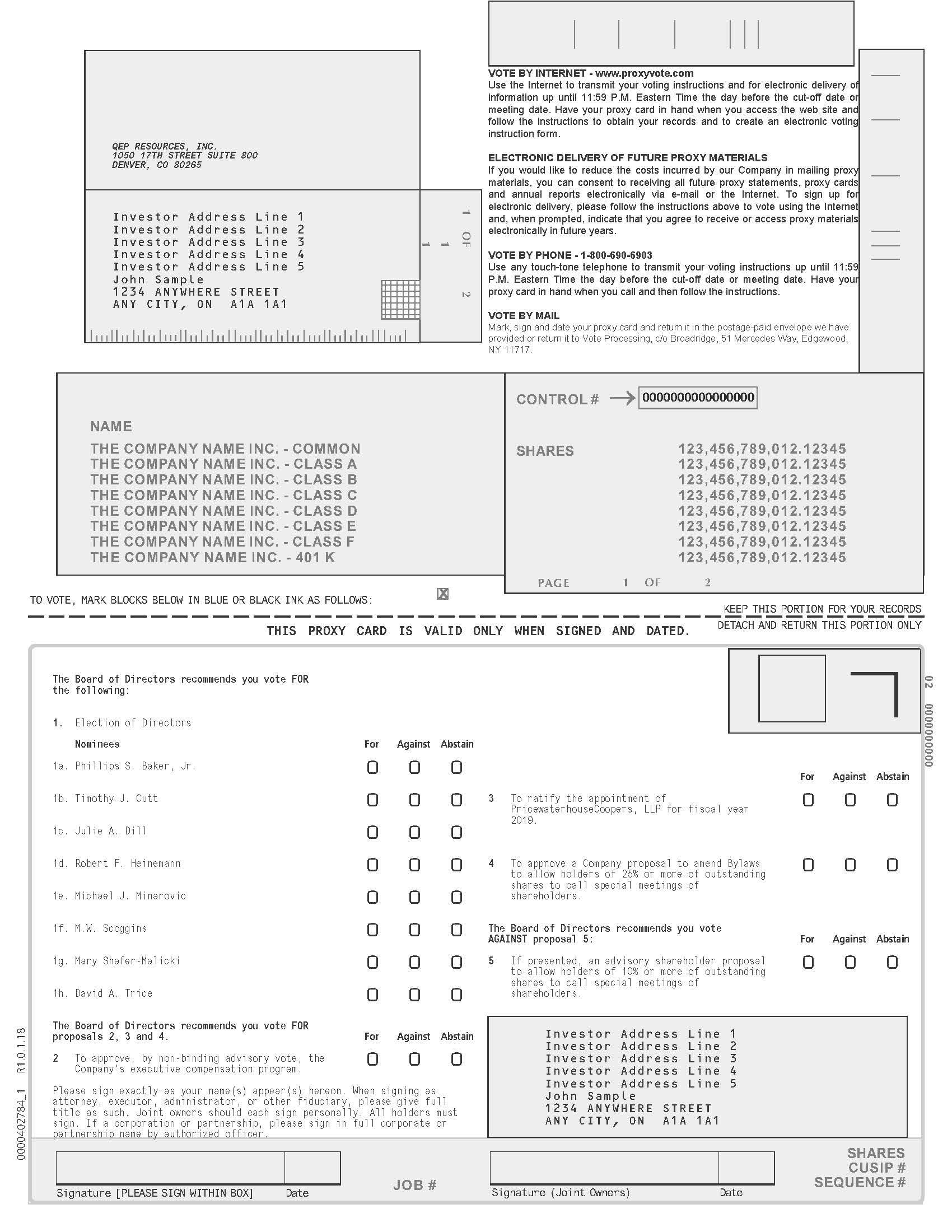

2. | If Item No. 1 to declassify our Board is approved, electElect eight directors nominated by our Board for one year terms, until their successors are duly elected and qualified (Item No. 2)1); |

| |

3. | If Item No. 1 to declassify our Board is not approved, to elect eight directors nominated by our Board to the class and for the term described in Item No. 3, until their successors are duly elected and qualified (Item No. 3); |

| |

4.2. | Approve, by non-binding advisory vote, the compensation of the Company’s named executive officers as disclosed in the accompanying proxy statement (Item No. 4)2); |

| |

5. | Approve the QEP Resources, Inc. 2018 Long-Term Incentive Plan (Item No. 5); |

| |

6.3. | Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm (Item No. 6)3); |

| |

| 4. | Vote on a Company proposal to amend the Company's Bylaws to allow holders of 25% or more of outstanding shares to call special meetings of shareholders (Item No. 4); |

| |

| 5. | Vote on an advisory shareholder proposal to allow holders of 10% or more of outstanding shares to call special meetings of shareholders (Item No. 5); and |

| |

7.6. | Transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Only holders of the Company's common stock at the close of business on March 26, 2018,28, 2019, the record date, may vote at the Annual Meeting or any adjournment or postponement thereof. If you are a record holder, you may revoke your proxy at any time before your proxy is voted. If you have shares registered in the name of a broker, bank or other nominee and plan to attend the meeting, please obtain a letter, account statement or other evidence of your beneficial ownership of shares to facilitate your admittance to the meeting. If you plan to vote at the meeting, you will need to present a valid proxy from the nominee that holds your shares. This proxy statement is being provided to shareholders on or about April 5, 2018.4, 2019.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote over the Internet as well as by telephone or by mailing a proxy card. Voting via the Internet, by phone or by written proxy will ensure your representation at the Annual Meeting if you do not attend in person. Please review the instructions you received regarding each of these voting options. Voting over the Internet or by telephone is fast and convenient, and your vote is immediately tabulated. By using the Internet or telephone, you help reduce the Company’s cost of postage and proxy tabulations.

|

| |

| | By Order of the |

| | Board of Directors |

| | |

| | Dane E. Allen |

| | Corporate Secretary |

Denver, Colorado

April 5, 20184, 2019

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 15, 2018.14, 2019. The proxy statement and annual report are available online at www.proxyvote.com.

TABLE OF CONTENTS

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ITEM NO. 1 – COMPANY PROPOSAL TO AMEND THE CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD AND PROVIDE FOR THE ANNUAL ELECTION OF DIRECTORS | |

ITEM NO. 2 – ELECTION OF DIRECTORS | |

| |

| |

| Director Nominees | |

Current Director (Term to Expire in 2019) | |

ITEM NO. 3 – ELECTION OF CLASSIFIED DIRECTORS (ITEM NO. 3 WILL NOT BE ADOPTED IF OUR SHAREHOLDERS APPROVE ITEM NO. 1) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Policies and Procedures for Review and Approval of Related-Person Transactions | |

| Related-Person Transactions | |

| |

| |

| |

| |

| |

| |

| |

| |

|

| |

| |

| Summary of 2018 Compensation Committee Actions | |

| |

| |

| |

Company Overview, 2017 Business Highlights and 2018 Strategic Initiatives | |

Strong Say on Pay Results and Summary of 2017 Compensation Actions | |

Response to 2017 Shareholder Feedback | |

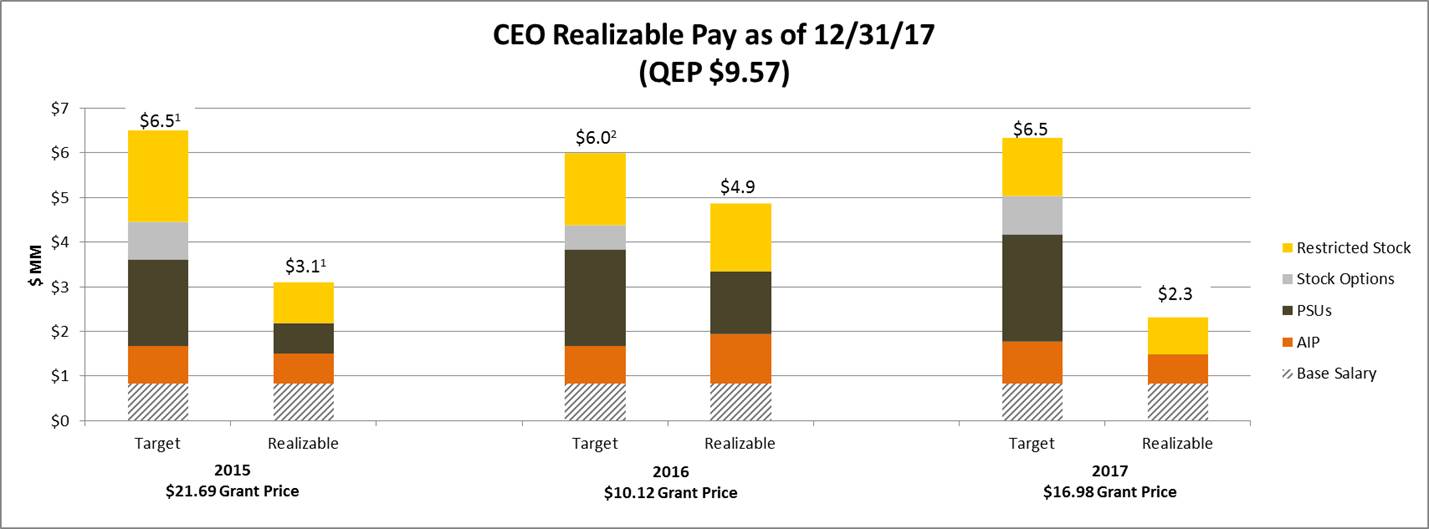

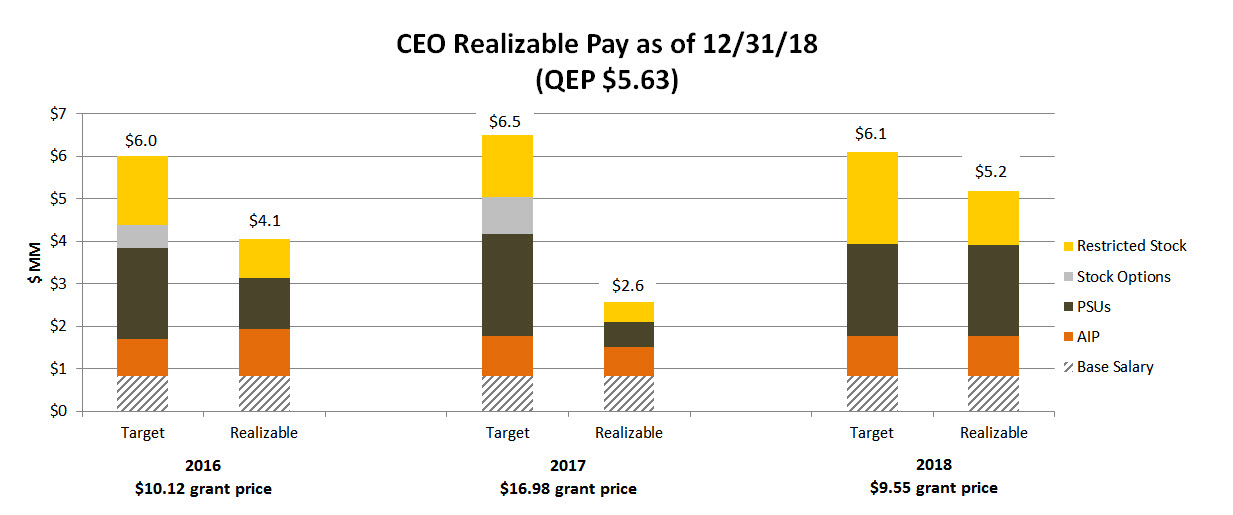

| Realizable Pay Demonstrates Pay and Performance Alignment | |

| |

| |

| |

| Base Salary | |

| |

| |

| 2018 Executive Severance Program | |

| |

| Compensation Committee's Decision Making Process | |

| Role of the Chief Executive Officer/Other Officers | |

| Role of the Independent Compensation Consultant | |

| Determination of Peer Group | |

| |

| |

| |

| |

| Taking | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ITEM NO. 42 – ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

ITEM NO. 5 – APPROVAL OF THE QEP RESOURCES, INC. 2018 LONG-TERM INCENTIVE PLAN | |

ITEM NO. 63 – RATIFICATION OF OUR INDEPENDENT AUDITOR | |

| ITEM NO. 4 – COMPANY PROPOSAL TO AMEND THE COMPANY'S BYLAWS TO ALLOW HOLDERS OF 25% OR MORE OF OUTSTANDING SHARES TO CALL SPECIAL MEETINGS OF SHAREHOLDERS | |

| ITEM NO. 5 – SHAREHOLDER PROPOSAL TO ALLOW HOLDERS OF 10% OR MORE OF OUTSTANDING SHARES TO CALL SPECIAL MEETINGS OF SHAREHOLDERS | |

| |

| |

| |

| |

| |

| APPENDIX A | |

APPENDIX B | |

QEP RESOURCES, INC.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 15, 201814, 2019

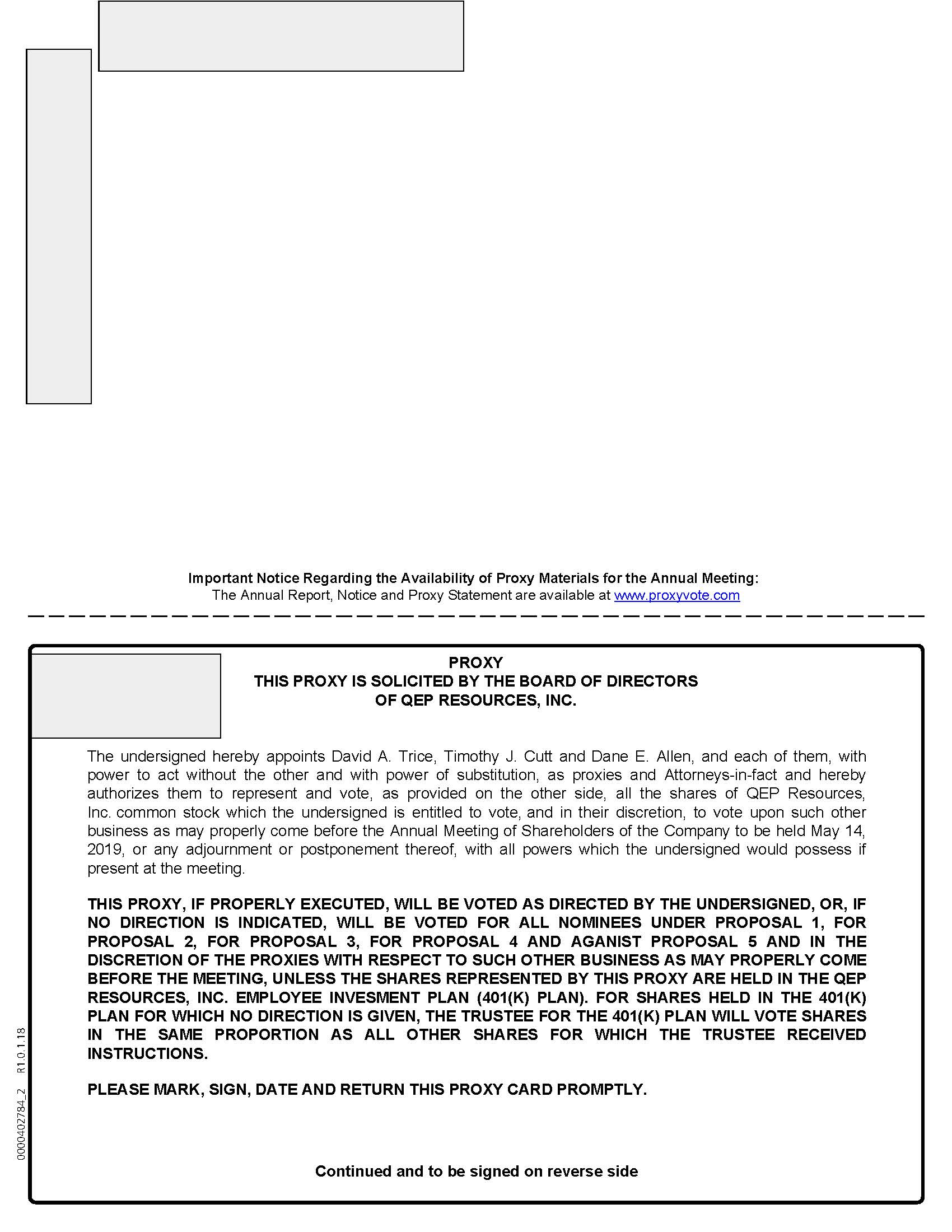

The Board of Directors (Board) of QEP Resources, Inc. (Company(the Company or QEP) is soliciting proxies for use at the Annual Meeting of Shareholders (Annual Meeting) to be held on May 15, 2018,14, 2019, beginning at 8:00 a.m. Mountain Daylight Time, at the Company's offices, 1050 17th Street, Second Floor, Denver, Colorado 80265, and any postponement or adjournment thereof. This proxy statement and the accompanying notice of annual meeting include information related to the Annual Meeting. Distribution of these proxy solicitation materials is scheduled to begin on or about March 30, 2018.April 4, 2019. The following information will help you to understand the voting process.

Proxy Materials

In accordance with rules promulgated by the Securities and Exchange Commission (SEC), we may furnish proxy materials, including this proxy statement and our Annual Report to Shareholders, by providing access to these documents on the Internet instead of mailing a printed copy of those materials to shareholders. Most shareholders have received a Notice of Internet Availability of Proxy Materials (the Notice), which provides instructions for accessing our proxy materials on a website or for requesting copies of the proxy materials by mail or email. If you would like to receive an email or paper copy of the proxy materials for the Annual Meeting and for future meetings, you should follow the instructions for requesting such materials included in the Notice.

Entitlement to Vote

Shareholders who owned shares of QEP common stock as of the close of business on March 26, 2018,28, 2019, the record date, may vote at the Annual Meeting. Each shareholder is entitled to one vote for each share of QEP common stock held by such shareholder on that date.

Voting Items

You will vote on a Company proposal to declassify the Board and provide for the annual election of directors.

This yearall eight directors (the Nominees): Phillips S. Baker, Jr., Timothy J. Cutt, Julie A. Dill, Robert F. Heinemann, Michael J. Minarovic, M.W. Scoggins, Mary Shafer-Malicki Charles B. Stanley and David A. Trice (the Nominees) will be nominated for election for the terms set forth in Item No. 2 or Item No. 3, as applicable.Trice. You will also vote on compensation of the Company's named executive officers (on an advisory basis), the approval of the QEP Resources, Inc. 2018 Long-Term Incentive Plan and the ratification of the appointment of PricewaterhouseCoopers LLP (PwC) as the Company's independent registered public accounting firm.firm, a Company proposal to amend the Company's Bylaws to allow holders of 25% or more of outstanding shares to call special meetings of shareholders, and an advisory shareholder proposal to allow holders of 10% or more of outstanding shares to call special meetings of shareholders.

Board Voting Recommendations

The Board recommends that you vote as follows on the proposals:

| |

| 1. | FOR the approval of the Company's proposal to amend the Company's Amended and Restated Certificate of Incorporation to declassify the Board and to provide for the annual election of directors (Item No. 1); |

| |

2. | FOR the approval of the eight individuals nominated by our Board for one year terms, until their successors are duly elected and qualified (Item No. 2)1);

|

| |

3. | FOR the approval of the eight individuals nominated by our Board to the class and term described herein if Item No. 1 is not approved (Item No. 3);

|

| |

4.2. | FOR the approval, by non-binding advisory vote, of the compensation of the Company's named executive officers as disclosed in the accompanying proxy statement (Item No. 4)2); |

| |

5. | FOR the approval of the QEP Resources, Inc. 2018 Long-Term Incentive Plan (Item No. 5);

|

| |

6.3. | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company's independent registered public accounting firm (Item No. 6)3); |

| |

| 4. | FOR the approval of the Company proposal to amend the Company's Bylaws to allow holders of 25% or more of outstanding shares to call special meetings of shareholders (Item No. 4); and |

| |

7.5. | Transact such other business as may properly come before the meetingAGAINST an advisory shareholder proposal to allow holders of 10% or any adjournment or postponement thereof.more of outstanding shares to call special meetings of shareholders (Item No. 5). |

Voting Instructions

You may vote via the Internet. You may vote by proxy over the Internet by following the instructions provided in the Notice or on the proxy card.

You may vote via telephone. You may vote by proxy over the telephone by following the instructions provided on the proxy card.

You may vote by mail. If you received a printed set of the proxy materials, you may vote by completing and returning the separate proxy card in the prepaid, addressed envelope.

You may vote in person at the meeting. All shareholders of record may vote in person by ballot at the Annual Meeting. Written ballots will be passed out to anyone who wants to vote at the meeting.

Shares Held by a Broker, Bank or Other Nominee

If your shares are held by a broker, bank or other nominee (i.e., in street name), please refer to the instructions provided by that broker, bank or nominee regarding how to vote your shares. If you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the nominee that holds your shares. New York Stock Exchange (NYSE) rules determine whether proposals presented at shareholder meetings are routine or not. If a proposal is routine, a broker or other entity holding shares for an owner in street name may vote on the proposal without receiving voting instructions from the owner. If a proposal is not routine, the broker or other entity may vote on the proposal only if the owner has provided voting instructions. A broker non-vote occurs when the broker or other entity is unable to vote because the proposal is not routine and the owner does not provide instructions. Pursuant to NYSE rules, if you hold your shares in street name and you do not provide instructions to your broker on Item No. 6,3, your broker may vote your shares at its discretion on this matter. If you hold your shares in street name and do not provide instructions to your broker on the remaining items, your broker may not vote your shares on these matters.

Shares Held in the QEP Resources, Inc. Employee Investment Plan

If you are a participant in the QEP Resources, Inc. Employee Investment Plan (the 401(k) Plan), the enclosed proxy card may also be used to direct Fidelity Management Trust Company (Fidelity), the trustee of the 401(k) Plan, on how you wish to vote the Company's shares that are credited to your account under the 401(k) Plan. If you do not provide your voting instructions to Fidelity by 11:59 p.m., Eastern Daylight Time, on May 14, 2018,13, 2019, Fidelity will vote the Company shares credited to your 401(k) Plan account in the same proportion as all other shares for which Fidelity received instructions.

Proxy Solicitation

The Company is soliciting your proxy and paying for the solicitation of proxies, and will reimburse banks, brokers and other nominees for reasonable charges to forward materials to beneficial holders. The Company has hired Georgeson LLC (Georgeson) to assist in the distribution of proxy materials and the solicitation of votes. The Company will pay Georgeson a base fee of $15,000,$13,500, plus customary costs and expenses, for these services and has agreed to indemnify Georgeson against certain liabilities in connection with its engagement.

Quorum Requirements

On March 26, 2018,28, 2019, the record date, the Company had _____________238,045,327 shares of common stock issued and outstanding. A majority of the issued and outstanding shares, or ____________119,022,664 shares, constitutes a quorum. Abstentions, withheld votes and broker non-votes are counted for determining whether a quorum is present.

Voting Standards

Company Proposal to Amend the Company's Certificate of Incorporation to Declassify the Board and Provide for the Annual Election of Directors. Pursuant to Article X of the Company's Amended and Restated Certificate of Incorporation, effective May 17, 2017 (Certificate of Incorporation), approval of the declassification of the Board in Item No. 1 requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock. For purposes of determining the vote outcome of Item No. 1, abstentions will be included in the vote totals, and, therefore, an abstention will have the same effect as a negative vote. Broker non-votes will not be included in the vote totals, and, therefore, will have no effect on the outcome of Item No. 1.

Election of Directors. Election of the director nominees named in Item No. 2 and Item No. 31 requires that each director be elected by a majority of the votes cast, meaning that the number of shares voted "for" a nominee must exceed the number of shares voted "against" such nominee. The Company has adopted a director resignation policy whereby any director who fails to receive a majority of the votes cast during an uncontested election must submit his or her resignation to the Board. For purposes of determining the vote outcome for each nominee, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the outcome of this vote. Shareholders may not cumulate votes in the election of directors.

Approval, by Non-Binding Advisory Vote, of the Compensation of the Company's Named Executive Officers. The vote to approve, on an advisory basis, the Company's executive compensation in Item No. 2 requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter. For purposes of determining the vote outcome of Item No. 2, abstentions will be included in the vote totals and, therefore, an abstention will have the same effect as a negative vote. Broker non-votes will not be included in the vote totals, and, therefore, will have no effect on the outcome of Item No. 2. Although non-binding, our Board and Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

Ratification of the Company's Independent Registered Public Accounting Firm. Ratification of the selection of PwC as the Company's independent registered public accounting firm for fiscal year 2019 in Item No. 3 requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter. If this selection is not ratified by shareholders, the Audit Committee may reconsider its decision to engage PwC. For purposes of determining the vote outcome of Item No. 3, abstentions will be included in the vote totals and, therefore, an abstention will have the same effect as a negative vote.

Company Proposal to Amend the Company's Bylaws to Allow Holders of 25% or More of Outstanding Shares to Call Special Meetings of Shareholders. The vote to approve an amendment of the Company's Bylaws in Item No. 4 requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter. For purposes of determining the vote outcome of Item No. 4, abstentions will be included in the vote totals and, therefore, an abstention will have the same effect as a negative vote. Broker non-votes will not be included in the vote totals, and, therefore, will have no effect on the outcome of Item No. 4. Although non-binding, our Board and Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

ApprovalShareholder Proposal to Allow Holders of the QEP Resources, Inc. 2018 Long-Term Incentive Plan.10% or More of Outstanding Shares to Call Special Meetings of Shareholders. Approval of the QEP Resources, Inc. 2018 Long-Term Incentive Planadvisory shareholder proposal in Item No. 5 requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the proposal.matter. For purposes of determining the vote outcome of Item No. 5, abstentions will be included in the vote totals and, therefore, an abstention will have the same effect as a negative vote. Broker non-votes will not be included in the vote totals, and, therefore, will have no effect on the outcome of Item No. 5.

Ratification of the Company's Independent Registered Public Accounting Firm. Ratification of the selection of PwC as the Company's independent registered public accounting firm for fiscal year 2018 in Item No. 6 requires the affirmative vote of a majority of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote on the matter. If this selection is not ratified by shareholders, the Audit Committee may reconsider its decision to engage PwC. For purposes of determining the vote outcome of Item No. 6, abstentions will be included in the vote totals and, therefore, an abstention will have the same effect as a negative vote.

Other than the items of business described in this proxy statement, we do not expect any other matter to come before the Annual Meeting. If any other matter is presented at the Annual Meeting, your signed proxy gives the named proxies authority to vote your shares at their discretion. If you submit a signed proxy card that does not include voting instructions, the proxy card will be voted "For"for the election of all nominees under Item No. 1, for Item No. 2, orfor Item No. 3, as the case may be,for Item No. 4, and "For" all other proposals,against Item No. 5, unless the shares represented by the proxy card are held in the 401(k) Plan. (TheThe trustee for the 401(k) Plan will vote shares for which no direction is given in the same proportion as all other shares for which the trustee received instructions.)

The Annual Meeting

Any shareholder of record as of March 26, 2018,28, 2019 may attend the Annual Meeting. If you own shares through a broker, bank or other nominee and you wish to attend the meeting, please obtain a letter, account statement or other evidence of your ownership of shares as of such date and bring it with you so that you may attend the meeting.

Revoking a Proxy

You may revoke your proxy by submitting a new proxy with a later date, including a proxy submitted via the Internet or telephone, or by notifying the Corporate Secretary before the meeting by mail at the address shown on the notice of annual meeting of shareholders. If you attend the Annual Meeting in person and vote by ballot, any previously submitted proxy will be revoked.

ITEM NO. 1 - COMPANY PROPOSAL TO AMEND THE CERTIFICATE OF INCORPORATION TO DECLASSIFY THE BOARD AND PROVIDE FOR THE ANNUAL ELECTION OF DIRECTORS

The Board adopted, and recommends that the shareholders approve, an amendment to Article V of the Certificate of Incorporation to provide for the elimination of the classified structure of the Board and for the annual election of directors (the Declassification Amendment). The Declassification Amendment, if approved, will allow our shareholders to vote on the election of our entire Board each year, starting with the annual meeting of the shareholders in 2019 (the 2019 Annual Meeting), rather than on the staggered basis that our current classified board structure requires. The proposed revisions to the Certificate of Incorporation are attached as Appendix A to this proxy statement.

All of our directors, except for Mr. William L. Thacker, III, will tender their resignations from the Board immediately prior to the Annual Meeting, with such resignations being immediately effective.

If our shareholders approve this Item No. 1 at the Annual Meeting, the eight individuals nominated for election to our Board in Item No. 2 will serve for a one-year term until the 2019 Annual Meeting. If our shareholders do not approve this Item No. 1, we will continue to have a classified Board structure and our stockholders will instead be asked to elect the eight individuals nominated for election to our Board to the class and for one, two or three year terms, in each case as described in Item No. 3. The Declassification Amendment would not change the present number of directors or the Board's authority to change that number and to fill any vacancies or newly created directorships.

In addition, if the Declassification Amendment is approved, the Board intends to cause the Declassification Amendment to be filed with the Secretary of State of the State of Delaware following the Annual Meeting and to adopt conforming amendments to the Board's Corporate Governance Guidelines.

Current Classified Board Structure

Under our Certificate of Incorporation, the Board is currently separated into three classes equal in size. Absent the earlier resignation or removal of a director, each year the shareholders are asked to elect the directors comprising one of the classes for a three-year term, such that every three years, all of the classes undergo elections. The term of the class of directors that includes Mr. Phillips S. Baker, Jr., Ms. Mary Shafer-Malicki, and Mr. Charles B. Stanley is set to expire at the Annual Meeting. The terms of the other two classes of directors are set to expire in 2019 and 2020, respectively. However, each of the current directors, other than Mr. Thacker, will tender their resignations from the Board immediately prior to the Annual Meeting, with such resignation being immediately effective. Under the current classified board structure, shareholders may only elect approximately one-third of the Board of Directors each year.

Rationale for Declassification

A majority of our shareholders expressed their support for declassification proposals contained in our 2013, 2014 and 2015 proxy statements. However, those proposals did not pass because our governing documents required a supermajority (80%) of outstanding shares to support those proposals. Based on input from our shareholders, the Company sought shareholder approval in 2016 and 2017 to amend our governing documents to replace the 80% requirement with a requirement that holders of not less than a majority of the outstanding shares of our common stock approve such proposals. These efforts were not successful in 2016, but our shareholders approved this change at the 2017 annual meeting. Although the Board believes that the classified board structure has promoted continuity and stability, encouraged a long-term perspective on the part of directors and may be beneficial in the event of an unsolicited takeover attempt, the Board recognizes the sentiment of shareholders and institutional investor groups in favor of the annual election of directors. In response to input from our shareholders, during 2017, the Board considered the various positions for and against a classified board and recognized that an annual election fosters board accountability, enables shareholders to express a view on each director's performance by means of an annual vote and supports the Company's ongoing efforts to maintain "best practices" in corporate governance. Based on the Company's desire to maintain best practices in corporate governance, as well as input received from shareholders, the Company is proposing the immediate elimination of its classified board as discussed below.

Shareholder Approval Required

The approval of this proposal will require the affirmative vote of the holders of not less than a majority of the outstanding shares of common stock of the Company. In determining whether this proposal has received the requisite number of affirmative votes, abstentions and broker non-votes will not be counted and will have the same effect as a vote against the proposal. If a shareholder returns a validly executed proxy, the shares represented by the proxy will be voted on the Declassification Amendment in the manner specified by the shareholder. If a shareholder does not specify the manner in which shares represented by a validly executed proxy are to be voted on this matter, such shares will be voted for the proposal.

The Board recommends that you vote FOR Item No. 1.

ITEM NO. 2 – ELECTION OF DIRECTORS

If our shareholders approve Item No. 1 at the Annual Meeting, our shareholders will beYou are asked to consider eight nominees for election to our Board. Each nominee would serve for a one-year term until the 20192020 Annual Meeting if our shareholders approve the Declassification Amendment (Item No. 1) at the Annual Meeting. If our shareholders do not approve the Declassification Amendment, the current classified board structure will remain in place and this Item No. 2 will not be submitted to a vote of our shareholders at the Annual Meeting, and instead Item No. 3 (Election of Classified Directors) will be submitted in its place.

Each of the director nominees has consented to being named in this proxy statement and to serve as a director if elected. However, in the event that any nominee is unwilling or unable to serve as a director, those named in the proxy may vote, at their discretion, for any other person.

Board Size and Elections

As noted above, each of Phillips S. Baker, Jr., Julie A. Dill, Robert F. Heinemann, Michael J. Minarovic, M. W. Scoggins, Mary Shafer-Malicki, Charles B. Stanley and David A. Trice (collectively, the Nominees) will tender his or her resignation from the Board immediately prior to the Annual Meeting, with such resignation being immediately effective.

Each Nominee and Mr. Thacker possesses considerable experience and unique knowledge of the Company's challenges and opportunities. We seek a balance of director skill sets, plan carefully for board succession and seek constant improvement through effective board evaluations. All of our current directors (eight of which we are nominatingnominated under this Item No. 2)1 are independent except for Mr. Stanley.Cutt. We empower independent directors through frequent board and committee executive sessions. We also annually appoint either a Chair of the Board or, if the Chair of the Board is not independent, an independent lead director. The Board exercises a strong independent oversight function. This oversight function is enhanced by our Audit, Compensation and Governance Committees, each of which is made up entirely of independent directors.

When evaluating potential director nominees, the Governance Committee considers each individual's

professional experience, areas of expertise and educational background in addition to general qualifications. The Governance Committee works with the Board to determine the appropriate mix of experiences, areas of

expertise and educational backgrounds in order to establish and maintain a Board that is strong and well-rounded in its collective knowledge and that can fulfill its responsibilities, perpetuate our long-term success and represent the interests of our shareholders. The Governance Committee regularly communicates with the Board to identify professional experiences, areas of expertise, educational backgrounds and other qualifications that affect our business and that are particularly desirable for our directors to possess in order to help meet specific Board needs, including:

Exploration and Production (E&P) experience as current or former executives, which gives directors specific insight into, and expertise that fosters active participation in, the development and implementation of our operating plan and business strategy;

Executive leadership experience, which gives directors who have served in significant leadership positions strong abilities to motivate and manage others and to identify and develop leadership qualities in others;

Accounting and financial expertise, which enables directors to analyze our financial statements, capital structure and complex financial transactions, and oversee our accounting and financial reporting processes;

Enterprise risk management experience, which contributes to oversight of management's risk monitoring and risk management programs and establishment of risk tolerance aligned with our strategy; and

Public company board and corporate governance experience, which provides directors with a solid understanding of their extensive and complex oversight responsibilities and furthers our goals of greater transparency and accountability for management and the Board, and protection of our shareholders' interests.

Our Certificate of Incorporation provides for a Board consisting of between seven and 11 directors, with the precise number to be determined by the Board. Currently the Board consists of nine directors, and is expected to continue tofollowing the retirement of William Thacker, will consist of nineeight directors after the Annual Meeting.

Our Certificate of Incorporation also currently provides for the Board to be divided into three classes of directors, as nearly equal in number as possible, serving staggered three-year terms. Directors must receive a majority of the votes cast for the election of directors, and any director who fails to receive a majority of the votes cast during an uncontested election must submit his or her resignation to the Board.

If Item No. 1 is approvedelected by our shareholders at the Annual Meeting, each Nominee will serve on the Board for a one year term expiring at the 20192020 Annual Meeting.

Director Qualification Table

The following table highlights each Nominee's and Mr. Thacker's specific skills, knowledge and experience. A particular director may possess other valuable skills, knowledge and experience not indicated below.

|

| | | | | |

| Name | Financial and Accounting | Exploration & Production | Executive Leadership | Enterprise Risk Management | Public Company Governance |

| Phillips S. Baker, Jr. | X | | X | X | X |

| Timothy J. Cutt | X | X | X | X | X |

| Julie A. Dill | X | | X | X | X |

| Robert F. Heinemann | X | X | X | X | X |

| Michael J. Minarovic | X | X | X | X | |

| M. W. Scoggins | X | X | X | X | X |

| Mary Shafer-Malicki | X | X | X | X | X |

Charles B. Stanley | X | X | X | X | X |

William L. Thacker, III | X | | X | X | X |

| David A. Trice | X | X | X | X | X |

Biographical information concerning our directors appears below. Unless otherwise indicated, such individuals have been engaged in the same principal occupation for the past five years. Ages are correct as of the date of this proxy statement.April 1, 2019.

Director Nominees

|

| |

| Mr. Phillips S. Baker, Jr., age 58,59, has served as a QEP director since June 2010. He served as a director of Questar from 2004 to 2010. Mr. Baker is the President, CEO and a director of Hecla Mining Company (Hecla), a gold and silver mining company. He served as Chief Financial Officer (CFO) of Hecla from May 2001 to June 2003, and as Chief Operating Officer of Hecla from November 2001 to May 2003, before being named CEO in May 2003. He has over 30 years of business experience, including 1819 years of financial management, more than ten years as CEO of an NYSE-listed company and more than 20 years of directorships of public companies. Mr. Baker has also served as Chairman of the Board for the National Mining Association since October 2017, and has been a Board member since 2010. He has also served as a Board member of the National Mining Hall of Fame and Museum. In concluding that Mr. Baker is qualified to serve as a director, the Board considered, among other things, his financial knowledge and his extensive executive management and financial experience. |

|

| |

| Mr. Timothy J. Cutt, age 58, is the President and Chief Executive Officer of QEP and has served as a director of QEP since January 15, 2019. Prior to joining QEP, Mr. Cutt was the Chief Executive Officer of Cobalt International Energy, a development-stage petroleum exploration and production company (2016 to 2018). Cobalt International voluntarily filed a petition for relief under Chapter 11 of the United States Bankruptcy Code on December 14, 2017, and a plan to sell all the assets of the company was approved on April 10, 2018. Prior to joining Cobalt International, Mr. Cutt served as President of the Petroleum Division of BHP Billiton, a global natural resources company (2013 to 2016), and prior to that he also served as President of Production for BHP Billiton's Petroleum Division (2007 to 2011). Prior to joining BHP Billiton, Mr. Cutt served in various roles at ExxonMobil in the prior 25 years, including President of ExxonMobil de Venezuela (2005 to 2007), President ExxonMobil Canada Energy (2004 to 2005), President Hibernia Management & Development Company (2001 to 2004) and Regional Coordinator, North America. He also served as a Board member of the American Petroleum Institute from 2013 to 2018. In concluding that Mr. Cutt is qualified to serve as a director, the Board considered, among other things, his 35 years of experience in the oil and gas industry. |

|

| |

| Ms. Julie A. Dill, age 58,59, has been a QEP director since May 2013. She most2013 and also currently serves as a director of Rayonier Advanced Materials Inc., and Inter Pipeline Ltd. Ms. Dill recently served as the Chief Communications Officer for Spectra Energy Corp. (Spectra) from 2013 until completion of Spectra's merger with Enbridge, Inc. (the Merger) in the first quarter of 2017. She also served on the board of Spectra Energy Partners from 2012 until the completion of the Merger. Ms. Dill has a wealth of experience in the energy sector, having served in a number of executive capacities in the natural gas and power industries. She served as the Group Vice President of Strategy for Spectra and the President and CEO of Spectra Energy Partners, LP from 2012 until 2013, and prior to that she served as President of Union Gas Limited from 2007 until 2011. Previously, she served in various financial and operational roles with Duke Energy, Duke Energy International and Shell Oil Company. Ms. Dill also serves on an advisory board for Centuri Construction, a subsidiary of Southwest Gas Holdings, and on an advisory board for Southern Star Central Gas Pipeline. She is also a member of the Advisory Council for the College of Business and Economics at New Mexico State University and also serves on the Memorial Hermann Hospital Community Relations Committee. In concluding that Ms. Dill is qualified to serve as a director, the Board considered, among other things, her experience as the President and CEO of a public company, her strong financial background and her more than 35 years of experience in the energy industry. |

|

| |

| Dr. Robert F. Heinemann, age 65,66, has served as a QEP director since January 2014. He brings significant exploration and production expertise to QEP's Board through his experience as President, CEO and a director of Berry Petroleum Company, where he developed and executed that company's growth and capital allocation strategies. He served as a director of Berry from 2002 until 2013, and as President and CEO from 2004 through 2013. Previously, Dr. Heinemann worked for Halliburton Company, Mobil Exploration and Producing as well as other Mobil entities, in positions of increasing responsibility. Dr. Heinemann currently serves on the board of directors of Chaparral Energy, LLC, where he has also served as Chairman of the Board since May 2017, Crescent Point Energy Corp., and Great Western Oil and Gas Company, LLC, where he was also Chairman of the Board from 2014 through 2016. He previously was a director of Yates Petroleum Corporation until its merger in late 2016 and he formerly served as Chairman of the Board of C12 Energy, LLC until late 2015. He has more than 30 years of experience in the oil and gas industry in a number of technical, operational, technology, management and executive roles. In concluding that Dr. Heinemann is qualified to serve as a director, the Board considered, among other things, his extensive operational background and executive experience in the oil and gas industry. |

|

| |

| Mr. Michael J. Minarovic, age 53,54, has been a QEP director since May 2017. Mr. Minarovic is the Co-Founder and Managing Director of Arena Energy, LP (Arena), an employee-owned exploration and production company focused on the Gulf of Mexico (GOM). Since founding Arena in 1999, Mr. Minarovic developed and executed a successful strategy of exploiting drilling opportunities in the GOM that were left behind after fifty years of drilling by the major oil companies. By completing a number of acquisitions and joint ventures, in addition to his responsibilities of reservoir engineering, risk management and opportunity generation, Mr. Minarovic grew Arena into one the largest private operators in the GOM, producing over 33,000 barrels of oil equivalent per day. Under his leadership, Arena achieved this success by investing over $3.2 billion in capital since 1999 without any outside equity participation. He is also the Managing Director and a Co-Founder of Arena Offshore, LP, an affiliated drilling and operating company that has been the second most active driller in the GOM during the past five years. Prior to co-founding Arena, Mr. Minarovic served as a petroleum engineer with Newfield Exploration Company and Conoco, Inc. Mr. Minarovic is an active member of the University of Texas PGE External Advisory Committee, Society of Petroleum Engineers, The John Cooper School Board of Trustees, and is an Executive Director of the United States Oil and Gas Association. In concluding that Mr. Minarovic is qualified to be nominated to our Board, the Board considered, among other things, his more than 2930 years of oil and gas experience working in the independent, private and public sectors, including his entrepreneurial, executive and operational expertise as well as his background in negotiating and managing acquisitions and joint ventures with large public companies. |

|

| |

| Dr. M. W. Scoggins, age 70,71, has been a QEP director since June 2010 and also currently serveshas served as a director of Laredo Petroleum, Inc. since 2012. Dr. Scoggins previously served as a director of Cobalt International Energy, Inc. and Laredo Petroleum,from 2010 until 2018, Trico Marine Services, Inc. He served as a director offrom 2005 until 2011, Venoco, Inc. from 2007 until 2012, and Questar Corporation from 2005 until 2010. He is President Emeritus of the Colorado School of Mines, an engineering and applied science research university. He served as Mines' President from June 2006 until his retirement in July 2015. Dr. Scoggins retired in 2004 after a 34-year career with Mobil Corp. and Exxon Mobil Corp. From 1999 to 2004, he served as Executive Vice President of Exxon Mobil Production Co. Prior to the merger of Mobil and Exxon in late 1999, Dr. Scoggins was President, International Exploration & Production and Global Exploration, and an officer and member of the executive committee of Mobil Oil Corp. He served on the board of Trico Marine Services from 2005 until 2011, and Venoco, Inc. from 2007 until 2012.

Dr. Scoggins has a Ph.D. in Petroleum Engineering from the University of Tulsa. In concluding that Dr. Scoggins is qualified to serve as a director, the Board considered, among other things, his extensive industry experience and his experience serving in senior executive positions in the upstream oil and gas business. |

|

| |

| Ms. Mary Shafer-Malicki, age 57,58, has served as a QEP director since July 2017 and also currently serves as a director of McDermott International, Inc. and Wood plc. Ms. Shafer-Malicki retired in 2009 after a 26-year career with BP Exploration Operating Company (BP) and Amoco Corporation. She served as Senior Vice President/CEO and Chief Operating Officer/General Manager for BP's operations in Angola from 2005 to 2009 and Director General for BP's operations in Vietnam from 2003 to 2005. Prior to this, she served as the Business Unit Leader for BP's Central North Sea gas business in Scotland from 2001 to 2003, General Manager for support services to all of BP's Continental Shelf upstream operations in the United Kingdom from 2000 to 2001, and President and General Manager for Amoco/BP's Dutch onshore and offshore production and gas storage operations in the Netherlands from 1998 to 2000. Ms. Shafer-Malicki currently serves as a director of the University of Wyoming Foundation as well as a member of industry advisory boards for the Chemical Engineering departments at the University of Wyoming and Oklahoma State University. In concluding that Ms.Shafer-Malicki is qualified to serve as a director, the Board considered, among other things, her extensive energy industry experience, including her serving in senior executive positions, and her experience as a director on multiple public company boards. Ms. Shafer-Malicki was appointed as a director by the Board in July 2017 as part of the Board's succession-planning process and was recommended as a director candidate by the Company's current lead director. |

|

| |

| Mr. Charles B. Stanley, age 59, has servedBoard Chair, who was serving as President, CEO and a director of QEP since June 2010 and Chairman ofLead Director at the Board since May 2012. He also served in the same roles for QEP Midstream Partners, GP, LLC, the general partner of QEP Midstream Partners, LP, from 2013 until December 2014. Mr. Stanley served as Executive Vice President of Questar Corporation (Questar) from 2002 to 2008 and as Executive Vice President and Chief Operating Officer from 2008 until 2010. He also served as a director of Questar from 2002 until 2010. Prior to joining Questar, he served as President, CEO and a director of El Paso Oil and Gas Canada from 2000 to 2002, and as President and CEO of Coastal Gas International Company from 1995 to 2000. He is a director of Hecla Mining Company and serves on the boards of various natural gas industry trade organizations, including the American Exploration and Production Council. Mr. Stanley has served as Chairman of America's Natural Gas Alliance, an industry association representing large independent natural gas producers. In concluding that Mr. Stanley is qualified to serve as a director, the Board considered, among other things, his more than 30 years of experience in the oil and gas industry.time.

|

|

| |

| Mr. David A. Trice, age 69,70, has been a QEP director since 2011.2011 and was appointed Chair of the Board in January 2019 after having served as Lead Director since May 2016. He was CEO of Newfield Exploration Company (Newfield), an oil and natural gas exploration and production company from 2000 until his retirement in 2009. He also served as Chairman of the Board of Newfield from 2004 until 2010. Mr. Trice has served as a director of New Jersey Resources Corporation since 2004, and McDermott International,Select Energy Services, Inc., since 2009.November 2017. Mr. Trice previously served as a director of McDermott International, Inc. from 2009 to 2018, Grant Prideco, Inc. from 2003 to 2008, as a director ofand Hornbeck Offshore Services, Inc. from 2002 until February 2011, and2011. He also served as a director of privately held Rockwater Energy Solutions, Inc., from 2012 until its merger with Select Energy Services in 2017, and at privately held Crazy Mountain Brewery, LLC from 2011 until January 2015. He is also a director of Rockwater Energy Solutions, Inc., a privately held company. He served as the Chairman of the American Exploration and Production Council from 2008 to 2009, and as Chairman of America'sAmerica’s Natural Gas Alliance from 2009 to 2010. In concluding that Mr. Trice is qualified to serve as a director, the Board considered, among other things, his experience as the CEO of a publicly traded independent exploration and production company. |

For Item No. 2,1, the Board recommends that you vote FOR each of the nominees listed above.

Current Director (Term to Expire in 2019)

|

| |

| William L. Thacker, III, age 72, has been a QEP director since February 2014.

Mr. Thacker served as non-executive Chairman of the Board of Copano Energy LLC from 2009 through 2013 (he served on the Copano board beginning in 2004). Previously, he served as Chairman and CEO of TEPPCO Partners. Mr. Thacker also served on the board of Pacific Energy Management prior to the sale of Pacific Energy Partners to Plains All American Pipeline in 2006. He served on the board of GenOn Energy Inc. from January 2006 until November 2012 when GenOn merged with NRG Energy. He also serves on the boards of the Kayne Anderson Midstream Energy Fund and the Kayne Anderson Energy Development Company. In concluding that Mr. Thacker is qualified to serve as a director, the Board considered, among other things, his extensive energy industry experience and his experience as a director on multiple public company boards.

|

ITEM NO. 3 – ELECTION OF CLASSIFIED DIRECTORS (ITEM NO. 3 WILL NOT BE ADOPTED IF OUR SHAREHOLDERS APPROVE ITEM NO.1)

Our shareholders will be asked to vote on this Item No. 3 only in the event that at the Annual Meeting the shareholders do not approve Item No. 1 (the adoption of the amendments to our Certificate of Incorporation to eliminate our classified Board). If the shareholders approve Item No. 1, then we will amend our Certificate of Incorporation to eliminate our classified Board by filing the Amended and Restated Certificate of Corporation, a form of which is attached as Appendix A to this proxy statement, with the Secretary of State of the State of Delaware, and the shareholders will proceed to vote on Item No. 2 and not this Item No. 3. If, however, the shareholders do not approve Item No. 1, a vote will be taken on this Item No. 3.

If the shareholders do not approve Item No. 1, the current classified board structure will remain in place. As such, each of the following are nominated for election to the class and for the term set forth in the table below.

|

| | |

Name | Class | Expiration of Term |

Robert F. Heinemann | I | 2020 |

Michael J. Minarovic | I | 2020 |

David A. Trice | I | 2020 |

Phillips S. Baker | II | 2021 |

Mary Shafer-Malicki | II | 2021 |

Charles B. Stanley | II | 2021 |

Julie A Dill | III | 2019 |

M. W. Scoggins | III | 2019 |

Each of the director nominees has consented to being named in this proxy statement and to serve as a director if elected. However, in the event that any nominee is unwilling or unable to serve as a director, those named in the proxy may vote, at their discretion, for any other person.

The Board recommends, only in the case that Item No. 2 is not approved, that you vote FOR each of the nominees listed above.

GOVERNANCE INFORMATION

Governance Update

There were several governance developments to highlight from the past year, including:

A company-supportedCompany-supported proposal to eliminate 80% supermajority voting received support fromimmediately declassify our Board was approved by our shareholders at the holders of over 80% of our then-outstanding shares, and, therefore, the proposal was approved.2018 Annual Meeting. The Company subsequently took steps to amend and restate its Certificate of Incorporation and Bylaws to implement the changes included in the proposal.proposal, and consequently all directors are now serving one-year terms ending at the 2019 Annual Meeting.

GivenAfter thorough review, the elimination ofBoard has approved amendments to the 80% supermajority voting requirement that has previously provedCompany's Bylaws, which are subject to be a barrier to approving the declassification of our Board, and feedback from our shareholders, our Board is recommendingshareholder approval in Item No. 14 below, that would provide holders of 25% or more of the Company's outstanding shares the right to call special meetings of shareholders.

In conjunction with the retirement of our shareholders approve changes to our Certificate of Incorporation that will declassify our Board over a one-year period.

The Board continued to focus on succession-planning by adding two new directors to the Board, which resulted in increasing the diversityformer CEO and the sizehiring of the Board. Additionally, theTim Cutt as our new CEO in early 2019, after thorough review, our Board decided to allow Mr. Thacker to servesplit the thirdrole of Chair and final year of his elected term even though he will be 72 years old at the upcoming annual meeting.CEO.

As noted in the "Shareholder Engagement""Shareholder Engagement" section below, the Company continued to focus on its shareholder outreach program during 2017,2018, contacting shareholders who collectively owned over 65%60% of our outstanding shares. The Company is committed to continuing annual shareholder outreach.

General Governance Information

We seek to implement best practices in corporate governance, including robust Code of Conduct, Corporate Governance Guidelines and committee charters, each of which is available on the Company's website at http://ir.qepres.com/phoenix.zhtml?c=237732&p=irol-govhighlights. These documents provide the framework for our corporate governance. Any of these documents will be furnished in print without charge to any interested party who requests them.

Shareholder Engagement

Continuous and transparent communication with our shareholders helps our Board and senior management team gain useful feedback on a wide range of topics including corporate governance matters and executive compensation. Accountability to shareholders is not only a mark of our good governance but an important component of our success. In keeping with our shareholder outreach efforts in 2015 and 2016,recent years as noted in "Governance Update"the "Governance Update" section above, in 20172018 we contacted shareholders who collectively owned in excess of 65%60% of our outstanding shares. The Board considered investor feedback on numerous corporate governance and executive compensation topics and this feedback was an important factor in deciding to split the role of our CEO and Chair in early 2019. Feedback from our investors was also an important factor when our Board decided to recommend approval of the Declassification Amendment (Itema Company proposal that would provide shareholders holding 25% or more of our outstanding shares to call a special meeting of shareholders (see Item No. 1) as well as decisions related4 below) and to also recommend that our executive compensation programs, as discussed in the Compensation Discussion and Analysis section below.shareholders not support a competing shareholder proposal (see Item No. 5 below). We value the feedback provided by our shareholders and look forward to continued, open dialogue on corporate governance issues, executive compensation decisions and other matters relevant to our business.

Director Independence

The Board evaluated all relationships between the Company and its directors and determined that all non-management directors currently serving on the Board (Phillips S. Baker, Jr., Julie A. Dill, Robert F. Heinemann, Michael J. Minarovic, M.W. Scoggins, Mary Shafer-Malicki, William L. Thacker, III, and David A. Trice) are independent under all applicable rules and regulations, including the listing requirements of the NYSE, as set forth in Section 303A.02 of the NYSE Listed Company Manual, and the Company's Corporate Governance Guidelines. The Board also determined that no independent director has a material relationship with the Company that could impair the director's independence. The criteria applied by our Board in determining independence are available on the Company's website at "http://media.corporate-ir.net/media_files/IROL/23/237732/Corporate%20Governance%20Guidelines%20-%20As%20Updated%205-16-16.pdf"205-16-16.pdf". The Board evaluates independence on an ongoing basis.

Board Leadership Structure

Based on the Board's experience, considerable engagement with shareholders and an assessment of research on this issue, the Board understands that there are a variety of viewpoints concerning a board's optimal leadership structure; that available empirical data concerning the impact of board leadership on shareholder value is inconclusive; and, accordingly, that there is no single, generally accepted approach to board leadership in the United States. Given the dynamic and competitive environment in which we operate, the Board believes that the right leadership structure may vary as circumstances change.

Currently,In the past, our Board believeshas believed that a strong Lead Director in addition toand a combined ChairmanChair and CEO allowwas the best structure, allowing our Lead Director to provide independent Board leadership and permitpermitting our ChairmanChair and CEO to use his knowledge of the Company to focus Board discussions. The combined role of Chairman and CEO also ensures that the Company presents its strategy toFurther, our shareholders employees and other stakeholders with a single voice. Our shareholders havehad historically demonstrated support for this approach with a strong majority opposing shareholder proposals in 2013 and 2016 to separate the roles of ChairmanChair and CEO. Moreover, during our meetings with shareholders over the last three years, there has been overwhelming support expressed for our current combined Chairman/CEO role.

TheIn conjunction with the departure of Charles B. Stanley in January 2019 after more than eight years at the Company, including more than six years as our Chair, and the hiring of Mr. Cutt as our new CEO, the Board decided to split the role of Chair and CEO and eliminate the Lead Director is selected byposition as part of the succession process. The Board believes that having an independent chair will encourage diversity of thinking, improve

board oversight, and allow our Board annually. Currently, David A. Trice is servingnew CEO to focus on the everyday demands of managing our Company as Lead Director, and he is expected towe continue to serve as Lead Director if he is elected pursuant to Item No. 2 or Item No. 3, as the case may be. In this role, Mr. Trice:

Presides at all executive sessions of the independent directors and the board meetings at which the Chairman is not present;

Serves as liaison between the Chairman and the independent directors;

Approves information sent to the Board;

Approves meeting agendas for the Board;

Approves meeting schedules to assure that there is sufficient time for discussion of all agenda items;

Has the authority to call meetings of the independent directors; and

Ensures that he is available for consultation and direct communication, if requested by major shareholders.execute on our strategic initiatives.

Board Committees

Our Board has an Audit Committee, Compensation Committee and a Governance Committee, each of which is composed solely of independent directors. As noted above, each committee has a charter that can be found on the Company's website at http://ir.qepres.com/phoenix.zhtml?c=237732&p=irol-govhighlights. The Company will provide each charter to any interested party who requests it in print without charge. The following section includes information about our Board committees. The members of our Board and the Board committees on which they currently serve are identified below. |

| | | |

| Director | Audit | Compensation | Governance |

| Phillips S. Baker, Jr. | X | | X |

| Timothy J. Cutt | | | |

| Julie A. Dill | X | | X |

| Robert F. Heinemann | X | Chair | |

| Michael J. Minarovic | X | X | |

| M. W. Scoggins | Chair | X | |

| Mary Shafer-Malicki | X | | X |

Charles B. Stanley | | | |

| William L. Thacker, III | | X | X |

| David A. Trice | | X | Chair |

Audit Committee

The Audit Committee reviews auditing, accounting, financial reporting and internal control functions, and oversees risk assessment and compliance activities. The Audit Committee has the sole authority to hire, compensate, retain, oversee and terminate the Company's independent registered public accounting firm. The Audit Committee also has sole authority to preapprove all terms and fees for audit services, audit-related services and other services to be performed by the Company’sCompany's independent registered public accounting firm. The Audit Committee also reviews any related-person transactions brought to its attention that could reasonably be expected to have a material impact on the Company's financial statements and determines whether any action is necessary.

The Audit Committee meets all the requirements set forth in Sections 303A.06 and 303A.07 of the NYSE Listed Company Manual. The Board has determined that all members of the Audit Committee satisfy the standards for independence as they relate to audit committees as set forth in Section 303A.02 of the NYSE Listed Company Manual and as set forth in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (Exchange Act). The Audit Committee frequently meets in executive sessions and meets with the internal auditors and independent auditors outside the presence of management. All Audit Committee members qualify as audit committee financial experts.

Compensation Committee

The Compensation Committee oversees our executive compensation program and benefit plans and policies; administers our short- and long-term incentive plans, including equity-based programs; oversees and annually reviews short- and long-term as well as emergency succession planning; approves compensation decisions for officers; recommends CEO total compensation to the full Board; and annually reviews the performance of the CEO. The Compensation Committee oversees the risk assessment of our executive and non-executive compensation programs. The Compensation Committee also considers and makes recommendations to the full Board regarding compensation for independent directors.

The Compensation Committee meets the independence requirements set forth in Section 303A.02 of the NYSE Listed Company Manual, and each member qualifies as an independent director under Rule 16b-3 of the

Exchange Act and as an outside director under Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee frequently meets in executive sessions and meets with its compensation consultant outside of the presence of management.

The Compensation Committee has authority to retain and dismiss compensation consultants and other advisors that provide objective advice, information and analysis regarding executive and director compensation. These consultants report directly to, and may meet separately with, the Compensation Committee, and may consult with the Compensation Committee ChairmanChair between meetings. The Compensation Committee retained Meridian Compensation Partners, LLC (Meridian) as its independent consultant to advise it as to executive and director compensation in 2017.2018. The Compensation Committee considered the factors outlined by the NYSE and determined that Meridian is independent under those factors, and that Meridian's work in 20172018 did not create any conflict of interest with respect to its representation of the Compensation Committee. See "Compensationthe "Compensation Process – Role of Independent Compensation Consultant"Consultant" in the Compensation Discussion and Analysis section for a description of Meridian's duties.

The Compensation Committee has authorized Mr. Stanley,Cutt, our CEO, and Margo Fiala,Lauren Miller, the Vice President of Human Resources, in their respective capacities as officers, to grant restricted stock to newly hired employees and for employee retention up to a limit of $250,000 per grant. This authority is subject to certain limitations, and does not extend to grants to officers or directors. The full Compensation Committee reviews each grant made by Mr. StanleyCutt or Ms. FialaMiller at its next meeting following any such grant. The Compensation Committee has also delegated to its Chair, currently Mr.Dr. Heinemann, authority to replenish the pool of shares to be granted by Mr. StanleyCutt or Ms. Fiala.Miller. The full Compensation Committee reviews any such replenishment at its next meeting following the replenishment.

Governance Committee

The Governance Committee, which also functions as the Company's nominating committee, is responsible for committee assignments; new director searches; drafting and revising the Corporate Governance Guidelines; conducting annual evaluations of the Board, its committees and individual directors; and making recommendations to the full Board on various governance issues. All members of the Governance Committee meet the independence requirements set forth in Section 303A.02 of the NYSE Listed Company Manual.

The Governance Committee's Charter defines the criteria for director nominees, including nominees recommended by shareholders and nominees selected by the Governance Committee. These criteria provide a framework for evaluating all nominees as well as incumbent directors. The key criteria are personal and professional integrity and ethics; experience in the Company's business; experience as a CEO, president, CFO or senior officer of a public company or extensive experience in finance or accounting; currently active in business at least part time or recently retired, with skills and experience needed to serve as a member of the Board; experience as a board member of another public company; willingness to commit time and resources to serve as a director; and good business judgment, including the ability to make independent analytical inquiries. The Governance Committee considers candidates who will contribute a broad range of knowledge, talents, skills and expertise, particularly in the areas of the oil and natural gas industry, strategic planning, accounting and finance, corporate governance, management and diversity of the Board in terms of race, gender, ethnicity or professional background, sufficient to provide prudent guidance about the Company's operations and interests. Board nominees must be less than 72 years of age, unless that requirement is waived by the Board.

The Governance Committee also considers any recommendations for director nominees made by shareholders. The Governance Committee evaluates nominees recommended by the shareholders using the same criteria it uses for other nominees.

We amended our Bylaws in December 2016 to permit a group of up to 20 shareholders who collectively have owned at least 3% of our outstanding capital stock for at least three consecutive years to submit director nominees for up to 20% of the Board for inclusion in our proxy statement if the shareholder(s) and the nominee(s) meet the other requirements in our Bylaws. We further amended our Bylaws in October 2017 to require the Company to provide to the shareholders additional information about director nominees in advance of the annual meeting, and to require that director nominees proposed by both our Board and our shareholders must complete and update background questionnaires regarding the director nominee's qualifications; to

authorize the presiding person at shareholder meetings to enact rules of conduct and determine if business has been properly brought before the meeting; and to require a majority of directors (instead of two directors) to call a special meeting. Shareholders who wish to nominate directors for inclusion in our proxy statement or at an annual meeting should follow the instructions in the "Shareholder"Other Matters - Shareholder Nominations and Proposals"Proposals" section below.

Board Risk Oversight

Our Board, as a whole and through its committees, is responsible for overseeing risk management. The Company's executive officers are responsible for day-to-day management of the material risks the Company faces. In its oversight role, our Board is charged with satisfying itself that the risk management processes designed by management are functioning effectively and as designed. Our Board and its committees regularly discuss material risk exposures, the disclosure of risks, the potential impact of risks on the Company and the efforts of management to address the identified risks.

A number of Board processes support our risk management program. The full Board regularly reviews operational, regulatory and environmental risks and discusses the Company's enterprise risk management program. The Board reviews and approves the capital budget and certain capital projects, the hedging policy, significant acquisitions and divestitures, equity and debt offerings, and other significant activities.

The Audit Committee plays an important role in risk management by assisting the Board in fulfilling its responsibility to oversee the integrity of the financial statements and our compliance with legal and regulatory requirements. The Audit Committee retains and interacts regularly with our independent auditors and also meets regularly with our internal auditors. Additionally, the Audit Committee reviews financial and accounting risk exposure; the Company's proved oil and gas reserves estimation process, reserve estimates, changes to reserve estimates and disclosures regarding reserve estimates; issues related to cybersecurity; and the Company's internal controls. The Audit Committee also oversees ethics and compliance procedures and reporting.

The Compensation Committee reviews the compensation program to ensure it is aligned with our compensation objectives and to address any potential risks it may create. The Compensation Committee has designed our short- and long-term compensation plans with features that reduce the likelihood of excessive risk-taking, including a balanced mix of cash and equity and short- and long-term incentives, an appropriate balance of operating and financial performance measures, a proper balance of fixed and at-risk compensation components, significant stock ownership requirements for officers, extended vesting schedules on equity grants, and caps on incentive awards.

Our Governance Committee's role in risk management includes regularly reviewing developments in corporate governance and reviewing our Corporate Governance Guidelines to recommend appropriate action to the full Board. The Governance Committee also provides input as to Board composition, size and committee assignments, and recommends adjustments to ensure that we have appropriate director expertise to oversee the Company's evolving business operations.

Stock Ownership Guidelines for Non-Employee Directors

Our Board adopted stock ownership guidelines for independent directors to align the interests of our directors with the interests of our shareholders and to promote our commitment to best practices in corporate governance. Within five years of beginning their service, independent directors are required to hold QEP shares with a value equal to five times the amount of each such director's annual cash compensation. Shares that count toward satisfaction of the guidelines include common stock owned by the director and phantom stock attributable to deferred compensation. Each of the independent directors who has served for five years or longer holds a sufficient number of shares to satisfy these guidelines. The Board reviewed these guidelines again in 20172018 and determined these guidelines were appropriate.

Limits on Board Service

Our directors may not serve on the board of directors of more than five public companies at any given time. Our CEO may not serve on more than two boards in addition to our Board at any given time. A member of our Audit Committee may not simultaneously serve on the audit committee of more than two other public companies at any given time unless the Board determines that such simultaneous service would not impair the director's ability to serve effectively on our Audit Committee.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during 20172018 were Dr. Heinemann, Mr. Minarovic, Dr. Scoggins, Mr. Trice, Mr. Thacker and Mr. Minarovic (since May 2017).Trice. No member of our Compensation Committee was at any time prior to or during 2017,2018, or the first three months of 2018,2019, an officer or employee of our Company. Additionally, no member of the Compensation Committee had any relationship with our Company requiring disclosure as a related-person transaction. During 2017,2018, no executive officer of our Company served on the compensation committee of any other entity that had one or more of its executive officers serving as a member of our Compensation Committee. Furthermore, no executive officer of our Company served on the Compensation Committee of another company that had one of its executive officers serve as a member of our Board.

Communications with Directors

Interested parties may communicate with the full Board, non-management directors as a group or individual directors, by sending a letter in care of the Corporate Secretary at QEP Resources, Inc., 1050 17th Street, Suite 800, Denver, Colorado 80265. Our Corporate Secretary has the authority to discard any solicitations, advertisements or other inappropriate communications, but will forward any other mail to the named director or group of directors.

Attendance at Meetings

The QEP Board and committees of the Board held the following number of meetings in 2017:2018:

|

| | | | |

| | Board | Audit Committee | Compensation Committee | Governance Committee |

| Number of Meetings | 10 | 7 | 6 | 4 |

|

| | | | |

| | Board | Audit Committee | Compensation Committee | Governance Committee |

| Number of Meetings | 21 | 7 | 6 | 4 |

Each director attended at least 75% of the aggregate of (1) the number of Board meetings held while he or she was a director; and (2) the number of meetings of all committees of the Board held while he or she served as a member of his or her respective committee. Our directors are expected to attend the Annual Meeting. All of the directors attended the 2017 Annual Meeting of Shareholders.Shareholders, except for Dr. Scoggins and Mr. Thacker.

Family Relationships

No director or executive officer is related to any other director or executive officer.

Director Retirement Policy

Our Board has adopted a retirement policy that permits an independent director to continue serving until the annual meeting following his or her 72nd birthday, provided that the director remains actively engaged in business, financial or community affairs. The Board does not believe that directors who retire, resign or otherwise materially change their position with their employers should necessarily leave the Board; however, they are required to submit a notice of any such retirement, resignation or change to the ChairmanChair of the Board and ChairmanChair of the Governance Committee. The Board will then review the continued appropriateness of Board membership under the changed circumstances. The Board may waive its director retirement requirements in certain situations. As noted above, the Board made a determination to allow Mr. Thacker, who will be 72 years old at the May 2018 annual meeting, to serve the third and final year of the term he was elected to by our shareholders in May 2016.

CERTAIN RELATIONSHIPS AND TRANSACTIONS WITH RELATED PERSONS

Transactions with related persons are those that involve our directors, executive officers, director nominees, greater than 5% shareholders, immediate family members of these persons or entities in which one of these persons has a direct or indirect material interest. Pursuant to the procedures described below, we review all transactions that would involve amounts exceeding $120,000 (the current threshold required to be disclosed in the proxy statement under SEC regulations) and certain other similar transactions.

Policies and Procedures for Review and Approval of Related-Person Transactions